Do you want to retire a millionaire? Unless you’re one of the lucky few who can build a successful business or who’s born with rich relatives, your best path toward that goal is likely to involve decades of investing, which will allow the power of compound growth to build your nest egg up for you. A diversified portfolio of high-quality stocks can work wonders if you give it enough time.

And what better place to find dominant companies with decades-long growth opportunities than in healthcare? Healthcare isn’t going anywhere, and it’s already a multitrillion-dollar industry in America. With that in mind, here are three of the best healthcare stocks money can buy right now.

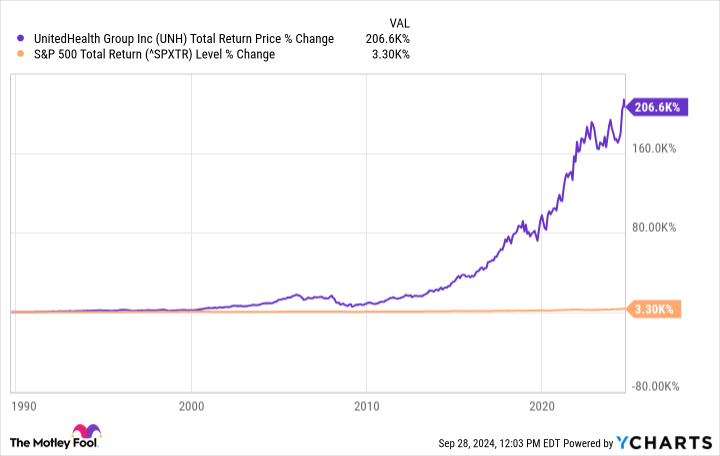

1. UnitedHealth Group

UnitedHealth Group (NYSE: UNH) is a massive conglomerate with two primary units. Its UnitedHealthcare segment provides health insurance and benefits to tens of millions in the United States, and more than 2 million in South America. Its Optum segment provides healthcare and pharmacy services to more than 100 million people, and technology services to hospitals and other healthcare providers.

Over the past four quarters, it generated over $380 billion in revenue. Its size is a competitive advantage for UnitedHealth, as it can offer more value for less money, which in turn helps it continue to take market share. UnitedHealth is a behemoth with a market cap of over $500 billion, yet it keeps growing. Analysts believe UnitedHealth can grow earnings by an average of 13% annually over the long term. The company has also boosted its dividend payouts for 15 consecutive years. The stock is poised to continue delivering stellar returns, assuming the company stays out of antitrust trouble.

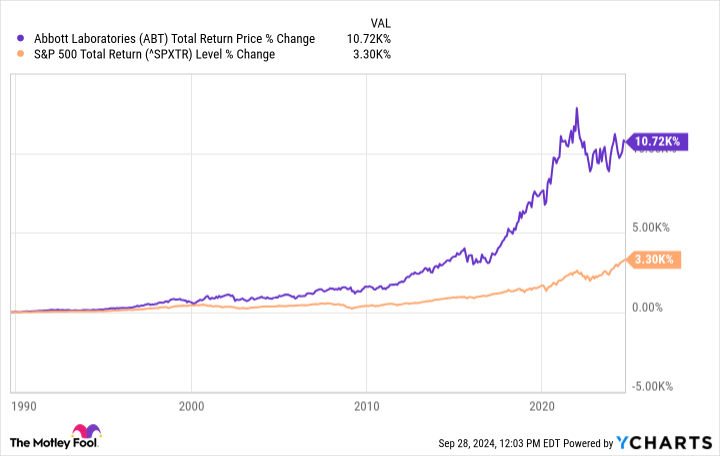

2. Abbott Labs

Healthcare products company Abbott Labs (NYSE: ABT) has evolved over the years. It spun off its primary pharmaceutical business over a decade ago into AbbVie, but that hasn’t held the parent company’s stock back from delivering market-beating returns. Today, Abbott Labs sells consumer health products, medical devices, testing equipment, and generic pharmaceuticals to emerging markets.

Abbott Labs is also a Dividend King with a 53-year payout-hiking streak, which investors looking for ever-increasing income from their portfolios should love. Today, it only spends about half its earnings on the dividend, so it should have plenty of room for future increases.

Most importantly, Abbott has positioned itself well for long-term growth. After spinning off AbbVie, the company aligned itself with growth trends in cardiovascular and diabetes care. Analysts covering the company on average believe that it will grow earnings by 8% to 9% annually over the long term, and the dividend adds almost 2% to investors’ returns. Abbott probably won’t provide explosive gains, but years of steady returns in the 8% to 10% range from growth and dividends can add up to life-changing wealth.

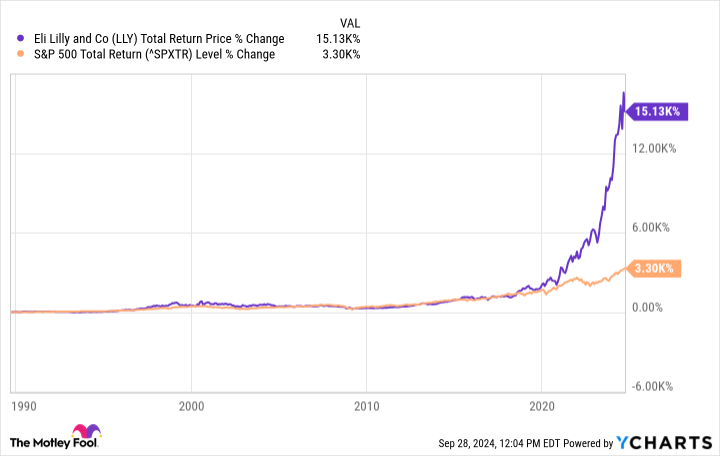

3. Eli Lilly

Pharmaceutical giant Eli Lilly (NYSE: LLY) might be the most explosive stock of these three. The company struck it big with its GLP-1 receptor agonist drugs Wegovy and Zepbound, which are prescribed for diabetes and weight loss, respectively. The combined sales of all GLP-1 drugs worldwide reached approximately $40 billion last year, and some forecasters expect that could nearly quadruple to $150 billion annually by 2032. Eli Lilly is one of a small number of pharmaceutical companies with FDA-approved GLP-1 products. However, Eli Lilly is far more than that: It has a deep pipeline and a broad portfolio that includes numerous products with growing sales.

Analysts believe Eli Lilly will deliver earnings growth that averages 20% annually over the next three to five years. Long-term investors shouldn’t sleep on Eli Lilly’s dividend potential, either. The company has raised its payouts for 10 consecutive years. While it only yields 0.6% today, the payout ratio is just 31% of this year’s estimated earnings. Look for management to ramp up that payout as Eli Lilly enjoys rapid growth over the coming years. That makes the stock a strong candidate for further market-beating total returns.

Should you invest $1,000 in UnitedHealth Group right now?

Before you buy stock in UnitedHealth Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UnitedHealth Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends AbbVie and Abbott Laboratories. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.

Want $1 Million in Retirement? 3 Stocks to Buy Now and Hold for Decades was originally published by The Motley Fool