Exchange-traded funds (ETFs) can provide you with simple, low-cost ways to invest in the stock market. Some of the best funds make it easy to quickly gain exposure to an array of promising investments, such as dividend stocks and fast-growing small businesses. Here are two ETFs that look particularly well-positioned to deliver lucrative gains to their shareowners.

This dividend-paying ETF can help you boost your passive income

When you’re rewarded with a steady stream of cash payments from your portfolio, the benefits of investing are made clear. You could use your dividend income to pay your bills, reduce debt, or invest in other wealth-building opportunities.

Better still, dividend-paying stocks tend to hold up relatively well during market declines. They’re also typically less volatile than stocks that do not pay dividends. Moreover, stocks that consistently raise their cash payouts can help you generate bountiful streams of passive income that grow steadily over time.

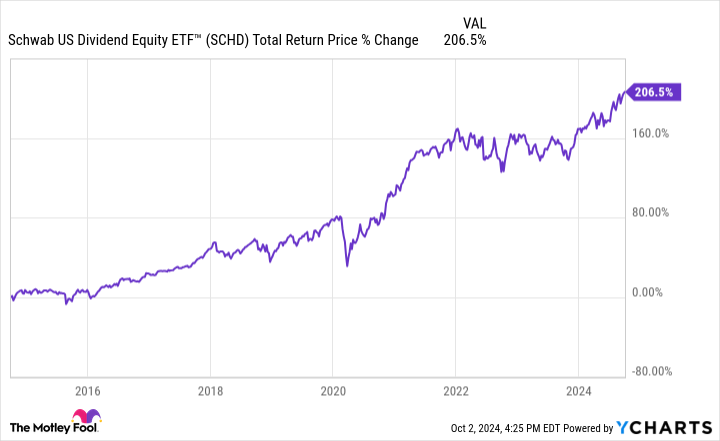

If these aspects of dividend investing sound appealing, consider the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD). This low-cost fund tracks an index comprised of financially sound businesses with proven histories of sustaining their dividend payments to shareholders. This intelligent strategy has helped Schwab’s ETF more than triple its investors’ money over the past decade.

To be eligible for inclusion in the index the Schwab U.S. Dividend Equity ETF tracks, a company must have at least 10 straight years of dividend payments. The index prioritizes businesses with solid profitability metrics and reasonable levels of debt. Stocks are screened and ranked based on fundamental performance metrics, such as return on equity and free cash flow, as well as shareholder return metrics, like annual dividend yield and five-year dividend growth rate.

With positions in roughly 100 companies, Schwab’s ETF is well-diversified across sectors. Major holdings include dividend stalwarts Home Depot, Verizon Communications, Chevron, Lockheed Martin, and Coca-Cola.

Importantly, Schwab charges low fees, so nearly all the fund’s returns will go to shareholders. The Schwab U.S. Dividend Equity ETF has an annual expense ratio of 0.06%, which equates to just $0.60 per $1,000 invested per year.

This small-cap ETF could magnify your gains

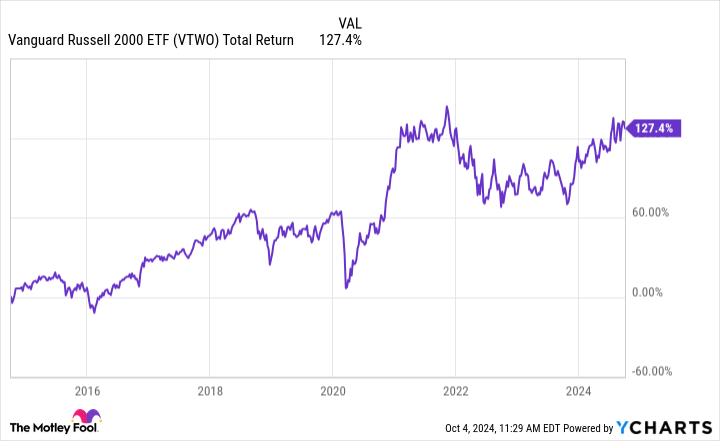

Small-cap stocks can add another powerful growth element to your portfolio. The Vanguard Russell 2000 ETF (NASDAQ: VTWO) offers you an easy way to invest in these high-potential and rapidly expanding businesses. It’s a smart approach that’s generated total shareholder returns of over 125% over the past 10 years.

As its name implies, Vanguard’s ETF holds stakes in roughly 2,000 stocks. With a median market value of $3 billion, these small-cap and mid-cap companies tend to have plenty of room for further growth. Vanguard’s fund thus pairs well with the Schwab U.S. Dividend Equity ETF, which holds mostly large-cap stocks. Owning both ETFs could provide you with a solid combination of proven performers and hard-charging upstarts.

Moreover, many of the stocks held by the Vanguard Russell 2000 ETF stand to benefit from economic stimulus measures. The Federal Reserve recently cut interest rates for the first time since early 2020, and the central bank is expected to implement more rate cuts in the coming months. Declining interest rates tend to have an outsized impact on smaller businesses that depend heavily on loans to fund their expansion. Lower financing costs, in turn, could spark a powerful rally in small-cap stocks.

The Vanguard Russell 2000 ETF, with its low annual expense ratio of 0.1%, is a smart, low-cost way to profit from a potential small-cap boom.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Joe Tenebruso has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron and Home Depot. The Motley Fool recommends Lockheed Martin and Verizon Communications. The Motley Fool has a disclosure policy.

Want to Get Richer? 2 Top ETFs to Buy Now was originally published by The Motley Fool