Privacy tokens face challenges meeting crypto exchange listing criteria amid regulatory pressure, leading to an all-time low in liquidity, Kaiko’s data shows.

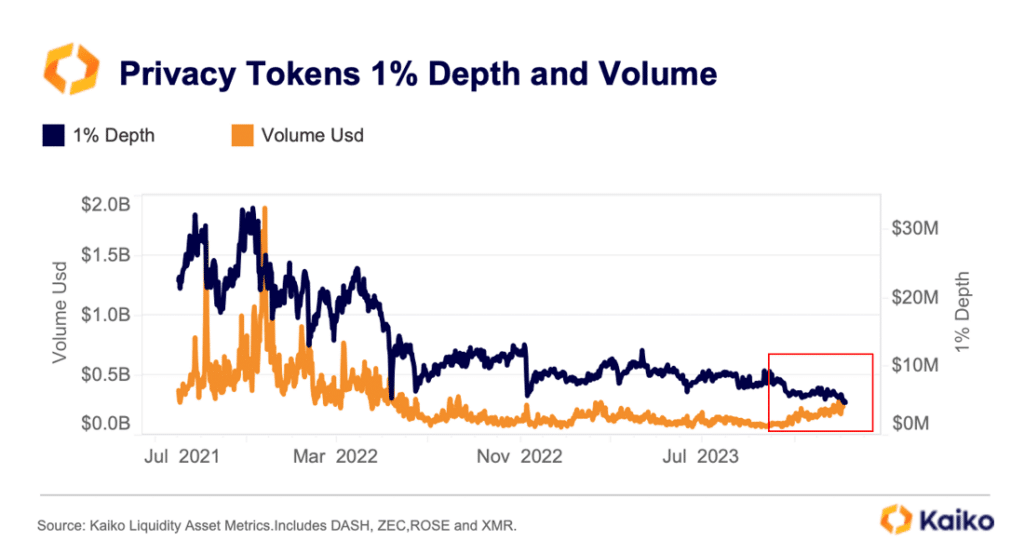

In a recent research report, analysts at Kaiko have revealed that market liquidity for privacy tokens — including Monero (XMR), Zcash (ZEC), and DASH — has reached all-time lows as crypto exchanges keep removing these assets from their listings. According to data, privacy-focused tokens witnessed last week just $5 million in liquidity following the removal of several trading pairs with these assets from OKX.

“While trade volumes gradually increased since October, they are still well below their 2021 levels.”

Kaiko

Analysts at Kaiko pointed out that privacy tokens have increasingly been delisted by major platforms due to regulatory pressure over the past few years.

This has helped to exacerbate the decline in liquidity during the crypto bear market. Both XMR and ZEC are currently at high risk of being delisted on Binance due to low liquidity, Kaiko notes, adding that ZEC has been the “most delisted privacy token over the past two years.” This has led to a greater fragmentation of the market, with XMR dominating on large exchanges, while ZEC and DASH are mostly traded on smaller unregulated venues, the analysts say.

In early January, crypto.news reported that Binance expanded the Monitoring Tag coverage with an additional 10 tokens, including Monero (XMR) and Zcash (ZEC). The move came amid increased attempts by Binance to bolster risk management after admitting to a litany of crimes in late 2023, including money laundering and failing to comply with know-your-customer (KYC) regulations stipulated by the U.S. Securities and Exchange Commission (SEC).

Despite the widespread delistings, not everyone in the crypto industry shares the same perspective. In September 2023, Ethereum co-founder Vitalik Buterin pointed out that centralized entities like custodial exchanges are “vulnerable” and can be corrupted, emphasizing that users should be able to transact directly on the Ethereum blockchain without relying on centralized providers.