(Bloomberg) — Honda Motor Co. sketched plans for a drawn-out deal that amounts to a takeover of Nissan Motor Co. in all but name, as Japan’s automakers struggle to keep up in an increasingly competitive global car industry.

Most Read from Bloomberg

The two announced a tentative agreement Monday to set up a joint holding company that will aim to list shares in August 2026. While their executives called the transaction a merger, Honda will take the lead in forming the new entity and nominate a majority of its directors. Nissan’s partner Mitsubishi Motors Corp. may also participate in the deal.

Honda and Nissan both are having trouble contending with ascendant domestic automakers in China, which surpassed Japan as the world’s largest car-exporting nation last year and is pulling further ahead in 2024. Honda Chief Executive Officer Toshihiro Mibe spoke to the level of difficulty ahead for the companies when he said during a press conference that their goal is to be competitive by 2030.

“Honda and Nissan merger synergies will take time to emerge if a deal is concluded in 2025,” Tatsuo Yoshida, a senior industry analyst for Bloomberg Intelligence, said in a note. “Nissan may get relief from its financial strain, while Honda’s near-term benefits may be limited.”

Honda did offer something of a sweetener for its shareholders, announcing plans to buy back as much as ¥1.1 trillion yen ($7 billion) of its stock by this time next year. The upper limit of the buyback amounts to 24% of issued shares.

A rescue by Honda would avert total disaster for Nissan and Mitsubishi Motors, whose standings have deteriorated since the arrest of their former Chairman Carlos Ghosn in November 2018. Just over a year after Nissan accused its longtime leader of financial misconduct, he fled Japan for Lebanon.

Ghosn, 70, has denied all charges and alleged Nissan defamed him.

Mitsubishi Motors, which is 24.5% owned by Nissan, signed a preliminary agreement to explore joining the deal with Honda, saying it expects to firm up the decision by the end of January.

Honda’s stock closed up 3.8% on Monday in Tokyo, recouping much of its loss since the deal talks were first reported last week. Shares of Nissan and Mitsubishi Motors rose 1.6% and 5.3%, respectively.

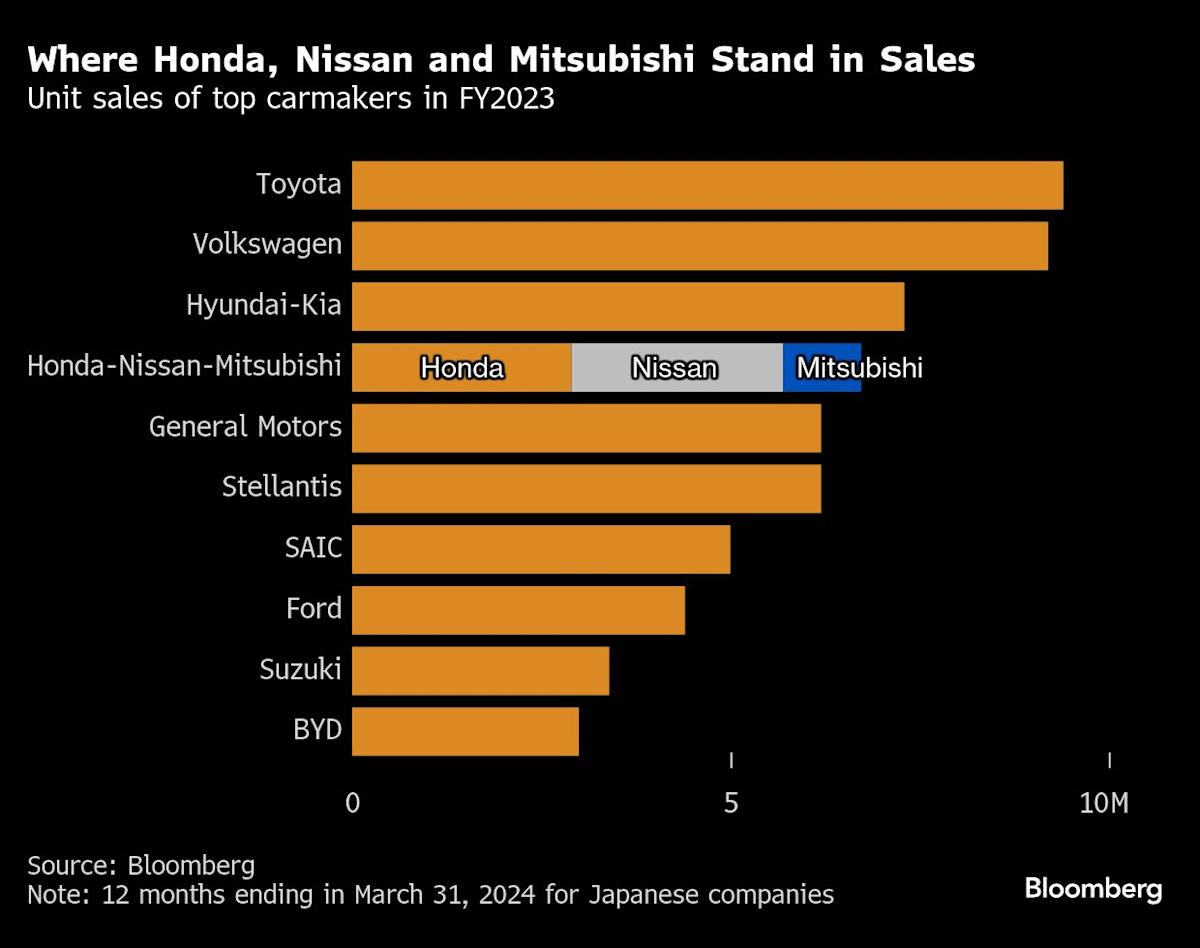

Combining the three companies would create one of the world’s largest carmakers, though the group would still be smaller than Japan’s Toyota Motor Corp. Joining forces also could bolster their efforts to ward off Chinese manufacturers led by BYD Co., which is now among the world’s leading electric-vehicle manufacturers.