A recent Quicktake analysis on the on-chain analytics platform CryptoQuant highlighted how Bitcoin’s short-term holders’ (STH) behaviour is similar to that of 2019. This analysis comes as Bitcoin remains below $60,000, continuing the bearish September trend.

Peak In Bitcoin’s Short-Term Holders Similar To 2019 Structure

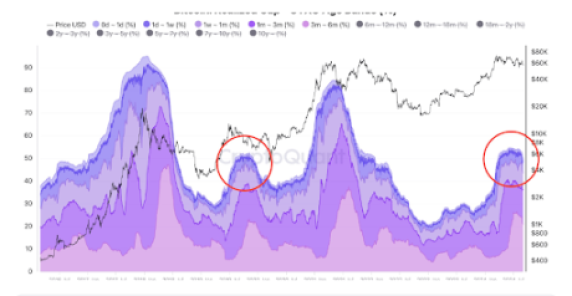

CryptoQuant contributor Avocado_onchain noted that there had been a “small peak” in Unspent Transaction Outputs (UXTOs) under six months, which resembles a similar structure observed in 2019. The analyst explained that these UXTOs under six months are new investors (or short-term holders) who entered the market around March of this year when Bitcoin’s price hit a new all-time high (ATH).

According to the analyst, the declining proportion of these UXTOs suggests that these investors have either exited the market due to Bitcoin’s choppy price action since March or have held and now transitioned to long-term holders (UTXOs of six months and above).

The accompanying chart showed that a similar structure occurred around the halving event in 2019 when Bitcoin also reached a local high. After that, Bitcoin’s price cooled off and took almost 490 days to hit a new ATH, although Avocado_onchain noted that there was also the impact of the COVID-19 pandemic.

This development undoubtedly provides insights into what Bitcoin investors could expect from the flagship crypto in the long term, even though its price remains choppy. Avocado_onchain remarked that he is confident about Bitcoin’s long-term upward trend. However, in the short term, he believes it will be wise for investors to “temper expectations and closely monitor the market.”

Meanwhile, although the analyst admitted that there is no clear trigger for a Bitcoin breakout, he noted that the influx of capital from new investors has historically been vital for Bitcoin’s price increases. Bitcoin hit a new ATH in March following the launch of the Spot Bitcoin ETFs, which introduced new money into the Bitcoin ecosystem.

Bitcoin Looks To Continue Bearish September Trend

Bitcoin looks to continue its bearish September trend this year, with the flagship crypto already down by over 4% since the month began. Historically, September is known to be a bearish month, as data from Coinglass shows that Bitcoin has suffered a monthly loss in six out of the last seven September, dating back to 2017.

Related Reading

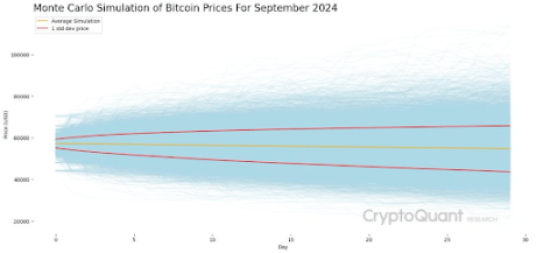

Following his simulation of Bitcoin’s price for this month, CryptoQuant’s Head of Research, Julio Moreno, mentioned that, on average, the flagship crypto could end the month at $55,000. Moreno had earlier mentioned that a drop below $56,000 for Bitcoin puts the crypto at risk of a deeper price correction and entering a prolonged bearish phase.

For now, the crypto community hopes that the US Federal Reserve will cut rates at its next FOMC meeting, which is scheduled for September 17 and 18. A rate cut is believed to be one that could trigger Bitcoin’s price and lead to a successful breakout above $60,000.

At the time of writing, Bitcoin is trading at around $56,400, down over 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com