Today I’m having a look at Costco and Target; two fellow big box retailers. Shares of retail powerhouse Costco (COST) have risen about 63%% over the past year, while Target (TGT) shares are up around 39% over the same time frame. Both stocks have performed well, but which is the better opportunity for investors going forward? Let’s examine that question.

I’m neutral on Costco based on its pricey valuation. Regarding Target, I’m bullish this stock based on its inexpensive valuation, attractive dividend yield, and long history of dividend growth. Additionally, sell-side analysts view Target as having considerably more upside ahead over the next 12 months.

The Setup

Costco is much beloved by investors, and rightfully so. The stock has generated handsome returns for its shareholders over the years, to the tune of nearly 900% over the past decade. Costco is often cited as being well managed and possessing an attractive business model due to recurring annual fees paid my its members.

Target has generated a total return of 224% over the past decade. Target is no slouch, but it has significantly lagged Costco’s performance over the past 10 years. However, this may create a more compelling setup for an investment in shares of Target today, as we’ll discuss next.

Massive Gap in Valuations

While Costco is a great business with a strong track record of performance, it trades at quite a steep multiple at this point in time. Costco has an off-cycle fiscal year that ends in August, and will soon report its Q4 2024 earnings results. The company trades above 50 times consensus 2025 earnings estimates. This sky-high multiple leaves little room for error going forward if the company disappoints investors in Q4 or during the next fiscal year.

Meanwhile, Target trades at a much more reasonable valuation of 14.8x forward earnings estimates, well below Costco’s multiple and also significantly below the S&P 500’s (SPX) forward valuation of 24x. One can certainly make a case that Costco is a higher-quality business than Target based on its recurring membership fees, but a valuation three times as expensive seems like too much of a gap.

Furthermore, despite Costco’s reputation for quality, Target is a higher-margin business, with gross margins of 26.1% approximately twice as high as Costco’s gross margins of 12.5%. Target’s profit margin of 4.2% is also noticeably higher than Costco’s 2.8%. From my perspective, Target’s significantly lower valuation offers the stock more downside protection and more room to surprise to the upside.

Two Strong Dividend Growth Stocks

Costco is a dividend stock, but its yield of 0.5% is fairly inconsequential. That said, Costco deserves credit for its strong dividend growth, having raised its dividend rate 19 years in a row.

Meanwhile, Target’s dividend yield is 2.9%. This is nearly six times higher than Costco’s current yield, and more than double the yield for the S&P 500. Target has an even more impressive track record of consistently paying and growing its dividend than Costco. Target is a Dividend King that has increased its payout for an incredible 55 years in a row.

Both companies also maintain relatively conservative payout ratios, meaning that both dividends look safe for the foreseeable future. While Costco has done a good job of growing its dividend, Target’s yield is significantly higher, and its consistent history of dividend growth is even better, which supports my bullish view of the stock.

Is COST Stock a Buy, According to Analysts?

Turning to Wall Street, COST earns a Strong Buy consensus rating based on 17 Buy, five Hold, and no Sell ratings assigned in the past three months. The average COST stock price target of $936.25 implies about 4.0% potential upside from current levels.

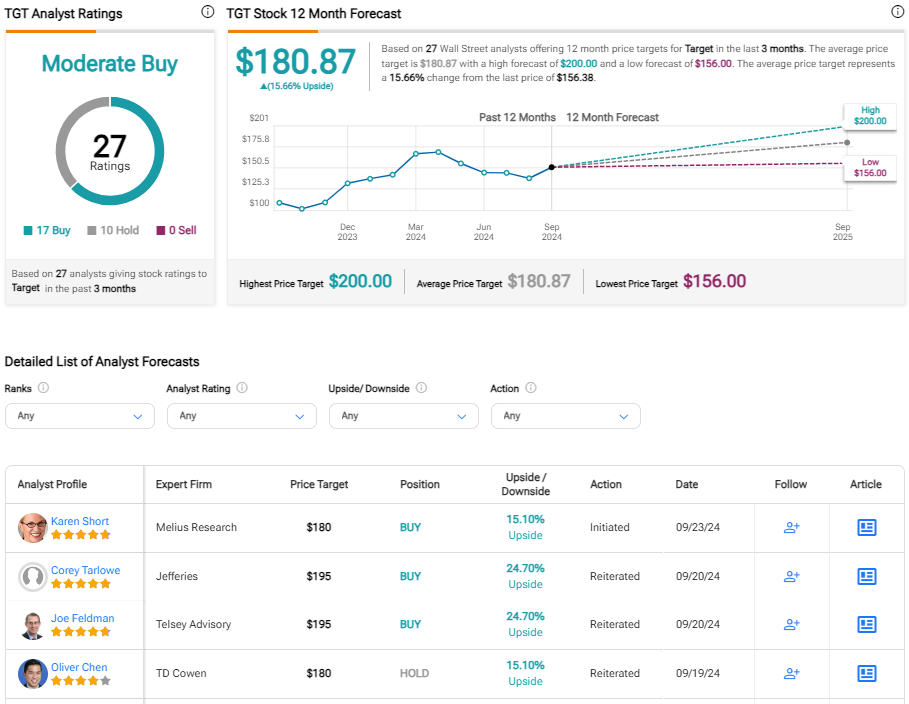

Is TGT Stock a Buy, According to Analysts?

At the same time, TGT earns a Moderate Buy consensus rating based on 17 Buys, 10 Holds, and zero Sell rating assigned in the past three months. The average TGT stock price target of $180.87 implies about 16% potential upside from current levels.

Smart Choices

As you can see using TipRanks’ Stock Comparison Tool below, both Costco and Target receive Outperform ratings from TipRanks’ Smart Score system.

Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. Scores of eight, nine, or 10 are considered equivalent to an Outperform rating.

Cocsto’s Outperform-equivalent Smart Score of nine is impressive, but Target comes out on top with a perfect-10 Smart Score.

Target Stock Looks Like the Preferred Investment Choice

Costco is a great company and has been a great performer for its shareholders over many years. However, I’m neutral on shares at this point as this strong run of performance has sent its valuation above 50x forward earnings, giving the stock little margin for error going forward.

Target trades at a much more attractive valuation of under 15x forward earnings, offers a higher dividend yield, and longer history of dividend growth. I’m bullish on Target given its inexpensive valuation, attractive dividend yield, and 55 straight years of dividend growth. Costco is a good stock with a dependable history of performance, but right now I view Target as the better investment option based on my assessment of the two choices.