Since its initial public offering in late 2020, Palantir Technologies (NYSE: PLTR) has been one of the most polarizing stocks on Wall Street. Jim Cramer recently referred to it as a “meme stock,” and last year, an online publisher of short reports labeled it an “AI imposter.“

Although its work with the U.S. military and intelligence agencies can cause Palantir to come across as elusive or secretive, I would argue that the negative sentiment surrounding the company is rooted in a misunderstanding of its business and value proposition. Simply put, Palantir is not your run-of-the-mill enterprise software company.

With its shares up by 145% during the past 12 months and the company’s induction on Sept. 23 into the S&P 500, it’s getting harder to buy the bearish narrative on Palantir. It has emerged as a darling of the artificial intelligence (AI) revolution, its partnerships with tech giants suggest that it’s a legitimate player, and it appears that its next phase of growth is just beginning.

I see fintech platform SoFi Technologies (NASDAQ: SOFI) in much the same way as Palantir, and I think its stock could follow a similar trajectory to the one Palantir took, making it a potentially lucrative buying opportunity right now.

Palantir’s trip down memory lane

When it went public, Palantir’s private-sector business was a relatively small part of its operation, and skeptics labeled the company a glorified government contractor. On top of that, 2022 was a brutal year in the stock market, and technology stocks in particular took a big hit. Two key features of the macroeconomic environment that year were abnormally high inflation and an aggressive shift in monetary policy featuring rising interest rates.

It didn’t take long for businesses to rein in their spending and tighten up their financial controls. As budgets shrank, so did sales of pricey software products such as cloud computing and AI analytics tools.

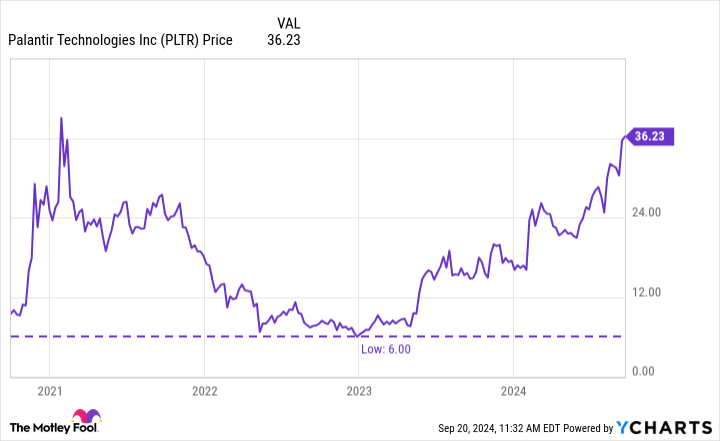

This took a toll on Palantir — and many of its cohorts — and its growth slowed dramatically. At the end of December 2022, Palantir stock hit an all-time low of just $6.

Not even two years later, its share price is now up more than sixfold from that nadir. What happened?

From a macro standpoint, interest in AI really started to take off in 2023, which reignited software spending.

From a company-specific standpoint, it released its fourth major product in April 2023: the Palantir Artificial Intelligence Platform (AIP). During the past year, AIP has served as a major catalyst and has helped the company really penetrate the private sector.

At the same time as it has been diversifying and increasing its revenue base, Palantir has been taking a disciplined approach to costs. As a result, it has widened its operating margins. Today, Palantir is consistently both free-cash-flow and net-income positive.

Unsurprisingly, some investors have changed their tune on Palantir and now see it as a true disrupter in technology’s newest emerging opportunities.

SoFi’s trajectory looks similar to Palantir’s

Due to the high levels of competition in the financial-services industry, some people doubt that online bank SoFi will ever really catch on. To me, that feels like a similar position to the one taken by those who felt that Palantir wouldn’t be able to succeed in the private-sector software market.

Yet SoFi’s business model does have a couple of unusual advantages that differentiate it from the competition. For starters, it does not have brick-and-mortar branch locations. Its digital-only approach can be a big selling point for younger customers who may not want to spend time going to a bank, and who might be more likely to have their loan applications rejected by traditional institutions.

SoFi also has a broad ecosystem of financial services beyond lending. It offers checking accounts and credit cards, for example, and its clients can use its app to invest in the stock market. That diversified suite of products is offered with a high level of convenience by a company that feels less archaic than legacy banks and brokerage firms.

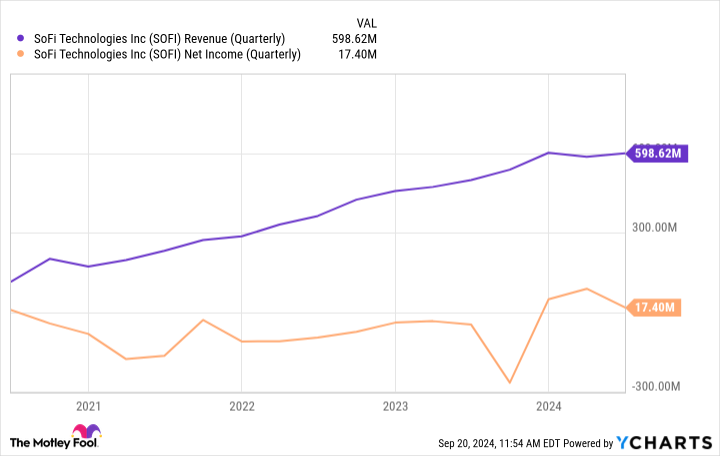

SoFi has done a nice job cross-selling various products to its customers, which has led to stronger unit economics and a transition from a cash-burning operation to a consistently profitable business.

These financial trends follow paths quite similar to those taken by Palantir. This is impressive considering SoFi’s largest source of growth, lending, has been little changed during 2024 due to high interest rates.

But just as the advent of AI played a major role in Palantir’s rebound, I view this month’s interest rate cut — and those that are expected to follow — as fresh catalysts for SoFi. Assuming the Fed delivers a series of rate cuts during the next year or more, I think SoFi’s lending business will accelerate, which should bolster the company’s overall profitability.

In sum, I see SoFi as another misunderstood and underappreciated opportunity. It’s more than just another bank, and I think during the next year, it could begin witnessing some notable accelerations in revenue and profitability if lending activity rebounds.

SoFi stock is down about 64% since it began trading on the Nasdaq in June 2021, but considering the potential for interest rate reductions to spur new growth in the lending segment, I would not be surprised to see the shares recover and follow a similar path to the one Palantir has charted since the start of 2023.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $710,860!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Adam Spatacco has positions in Palantir Technologies and SoFi Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Prediction: This Will Be the Next Stock to Follow Palantir’s Path was originally published by The Motley Fool