Stock splits have been a big thing this year, with top companies across industries launching these efforts to lower their high-flying stock prices. A stock split, by issuing new shares to current holders, decreases the per-share price of a company. And among these stock split announcements, many have come from artificial intelligence (AI) players — from Nvidia to Broadcom.

That’s as shares of companies operating in this high-growth space have taken off. For example, Nvidia and Broadcom have seen their shares climb more than 300% and 200%, respectively, over the past three years.

And today, with prices of AI stocks still reaching well into the hundreds of dollars, the stock split wave isn’t over. In fact, one stock in particular looks like an excellent candidate thanks to its solid growth in recent years, top share price performance, and long-term prospects.

Trading for more than $500 a share

Which company am I talking about? My prediction is Meta Platforms (NASDAQ: META) will be the next AI stock to split. The stock has climbed nearly 50% this year and is trading for more than $500 a share. Meta is a member of the “Magnificent Seven,” a top-performing group of technology stocks that have led market gains over the past year — and it’s the only one that has never completed a stock split.

So, let’s consider why a stock split would be a good idea for Meta. It’s true that these operations don’t act as catalysts for stock movement because they don’t change anything fundamental about a company — investors won’t buy a stock just because it launched a stock split. Stock splits don’t impact valuation, so a stock won’t become cheaper after the operation even though its per-share price is lower.

But a split still can be a very positive move for a company over the long term for two reasons. First, by lowering the per-share price, a split opens the investment opportunity up to a broader range of investors. Many no longer will have to turn to fractional shares — which may not even be available through their brokerage — to invest in the stock.

Second, a stock split signals to the investment community that the company is optimistic about its future. The idea is, from the new lower price, that particular stock can once again roar higher over time.

One of the cheapest Magnificent Seven stocks

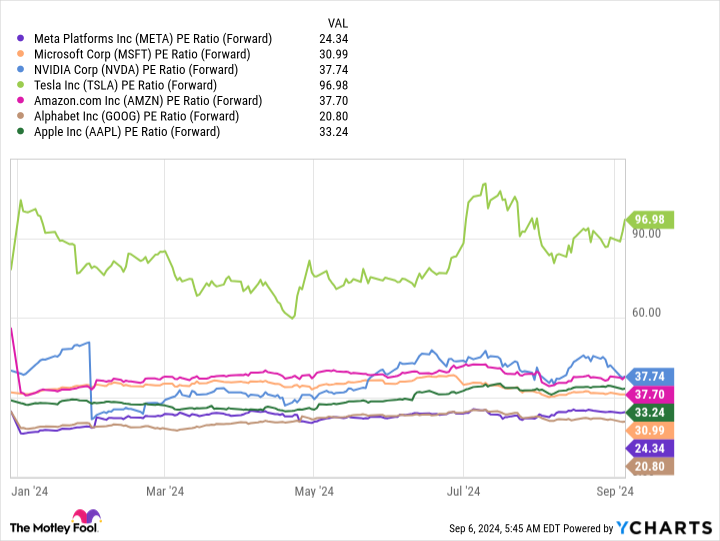

Meta still is one of the least expensive of the Magnificent Seven, the second-cheapest after Alphabet when considering forward earnings estimates.

But at its current per-share price, it may be progressing into out-of-reach territory for some investors. By lowering the price, Meta could expand its potential investor pool. Now is a great time to launch a split because investors are interested in companies that are highly involved in AI, seen as an area with explosive potential well into the future.

The AI market is expected to grow from $200 billion today to more than $1 trillion by the end of the decade. Meta aims to be at the forefront and is pouring investment into AI to make that happen. The company has made the technology its biggest investment area this year and has said it expects to have 600,000 of H100 equivalents in graphics processing unit compute on board by the end of the year.

You probably know Meta best for its social media apps, from Facebook to Instagram, and these top platforms bring in billions of dollars in revenue through advertising. Meta wants to use AI to make these apps better, which should attract more and more ad revenue over time — and the company’s aggressive AI investment could expand its product and service offerings as well.

Meta’s solid track record of earnings growth means it has the resources necessary to carry out its plan. Earlier this year, the company launched its first dividend, saying it has the financial strength to reward shareholders and fund growth.

So the timing looks right for a stock split from this company that’s making AI its priority, and that’s why my prediction is Meta will be the next on the AI stock split list.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $656,938!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adria Cimino has positions in Amazon and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: This Will Be the Next Artificial Intelligence (AI) Stock Split was originally published by The Motley Fool