It might be hard for investors to get excited about a company that has lost nearly $1.5 billion from its operations in the first half of this year. In fact, Chinese electric vehicle (EV) maker Nio (NYSE: NIO) has never made a profit.

That helps explain why the stock has lost more than 80% of its value over the past three years. But there was also some meaningful and positive news in Nio’s second-quarter report. That business momentum has translated to the stock price, as Nio’s American depositary shares have surged more than 40% in the last month.

The company’s market cap is now at about $11 billion, and the EV maker ended the quarter with $5.7 billion in cash and equivalents. That makes now a good time to look at what Nio’s next big move will be and whether it’s a stock that should be in your portfolio.

A step toward profits

One of the most notable achievements from Nio in Q2 was to significantly boost its vehicle profit margin. Vehicle margin, which is based on revenue and cost of new vehicle sales, was 12.2% in the quarter, compared to just 6.2% in the prior-year period. That was helped by revenue that nearly doubled year over year.

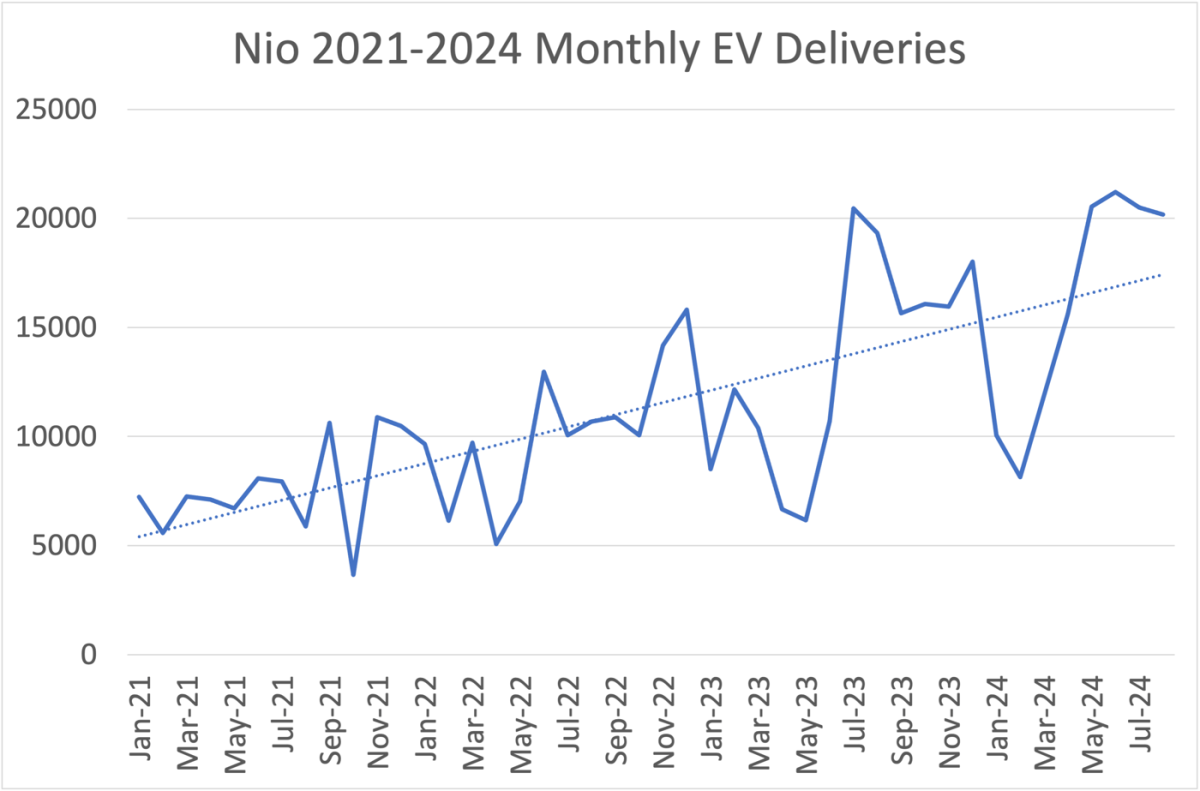

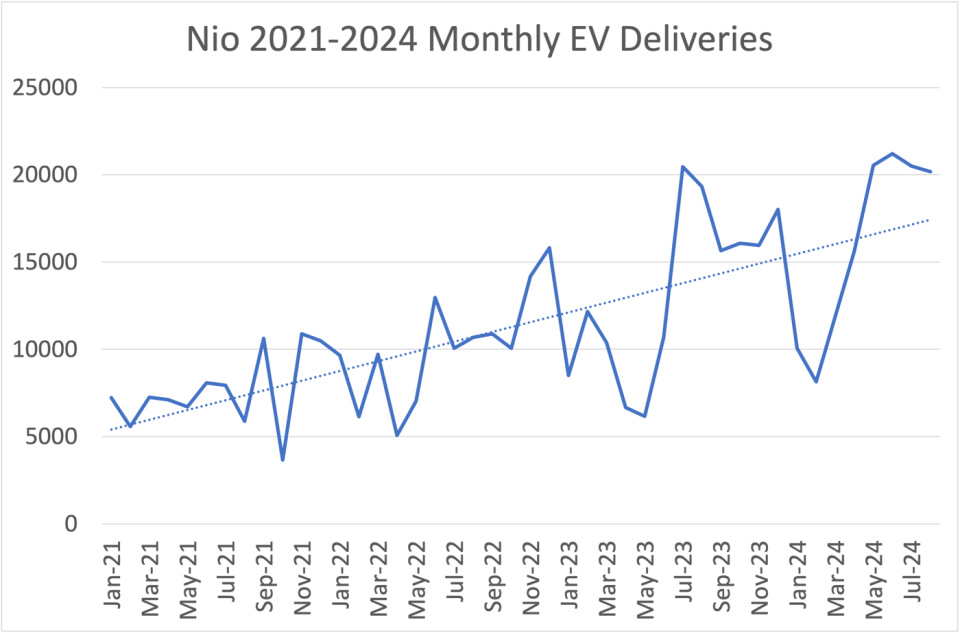

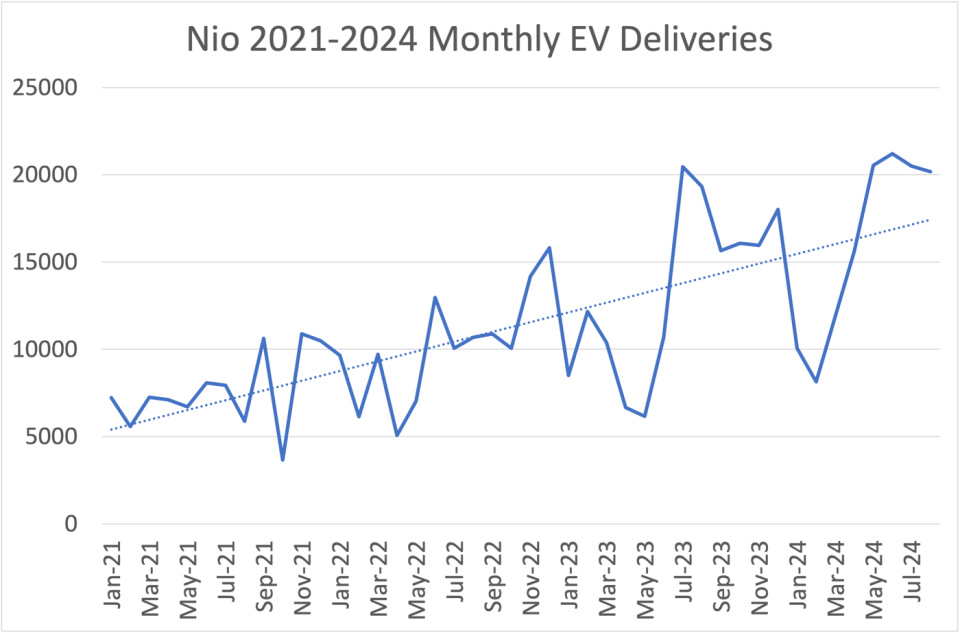

After years of fits and starts, it appears that Nio is finally hitting its stride in vehicle production and sales growth. That comes as global competition has grown in the EV sector. Nio has sold over 20,000 EVs for four consecutive months for the first time. That has aided in gaining market share and boosting margins.

The company just set a new quarterly record with more than 57,000 units shipped. It also provided guidance for third-quarter vehicle deliveries in a range of 61,000 to 63,000 EVs. Nio’s CEO William Li noted that the company’s Q2 sales volume led it to securing more than 40% of market share within China for EVs priced above the equivalent of about $42,000. And Nio has a plan to keep expanding. Its focus on the luxury end of the market has helped it compete against Chinese EV leader BYD, which claims the lion’s share of the lower-priced Chinese EV market.

Addressing range anxiety

Nio has been a leader in China and elsewhere in working to expand battery charging and its unique battery swapping technology. Nio’s battery swap stations give EV buyers the option to lower the upfront vehicle cost by paying a monthly subscription for its Battery as a Service (BaaS) plan. Drivers can use its swap stations to replace drained batteries with freshly charged ones, a process that takes only minutes.

Last month, Nio announced a new plan to strengthen its charging and battery swapping network across China. Its “Power Up Counties” plan will accelerate the buildout of those networks.

As of Aug. 31, Nio had over 2,500 battery swap stations globally, with over 800 strategically located on China’s expressways. With over 577,000 Nio vehicles on the roads, it has provided battery swaps more than 50 million times. Its new plan will result in power swap stations being available in thousands of Chinese counties by the end of next year. It also plans to build a new factory to create up to 1,000 power swap stations annually.

Mass market brand

Nio’s new Onvo brand will also utilize the expanding charging and swapping networks. Onvo is Nio’s new entry-level EV brand that seeks to tap more of a mass market and take on Tesla‘s Model Y. The Onvo L60 mid-size SUV has a starting price of about $30,000.

That brand, combined with Nio’s existing and growing charging technology and infrastructure, could be the next driver for Nio’s business and the stock. Investors who are willing to be aggressive could add Nio stock now, anticipating its next phase of growth with Onvo. Otherwise, watch for signs that Onvo is gaining traction to be somewhat more conservative and still potentially get ahead of Nio’s next big move.

Should you invest $1,000 in Nio right now?

Before you buy stock in Nio, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nio wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $722,320!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 16, 2024

Howard Smith has positions in BYD Company, Nio, and Tesla. The Motley Fool has positions in and recommends BYD Company and Tesla. The Motley Fool has a disclosure policy.

Prediction: This Will Be Nio’s Next Big Move was originally published by The Motley Fool