California may be a veritable paradise on Earth, with a salutary climate, famously pleasant weather year-round, and abundant natural resources, but it’s no secret that the Golden State also has its share of natural disasters. Recent years have seen an acceleration of wildfires in California, born of warm weather, extensive forests – and human activity. Of the 20 largest wildfires recorded in the state, 13 have occurred in just the last decade.

The year 2019 was a particularly difficult year for California, as the wildfires were devastating and widespread, and in some cases were started by problems in the state’s utility grid. Equally controversial, 2019’s firefighting efforts saw some of the state’s major power companies cut electricity to more than 800,000 customers.

That kind of environment does not encourage investment in the power companies. Nonetheless, California has recently been working to restore investor confidence, a shift that has caught the attention of Bank of America analyst Ross Fowler.

“Investors have been slow to come back to the state following the devastating wildfires seen in 2017-2019. The discount has improved from the troughs established in 2020, but we think financial protections established under AB 1054 – aka the California Wildfire Fund – and the state’s widespread efforts to mitigate the risk of catastrophic fires are underappreciated. California boasts some of the best mechanisms in the country,” Fowler opined.

The Bank of America analyst follows this up by choosing 2 top picks from California’s power companies, spotlighting those set to thrive in the state’s evolving energy landscape. Let’s take a closer look.

PG&E (PCG)

The first Bank of America pick is PG&E, or Pacific Gas & Electric. The company is an investor-owned utility, or IOU, a private-sector firm that acts as a public utility provider, and was founded in 1905. PG&E is not unique as an investor-owned utility in California; the state has six such companies providing electric power. The power utility niche is profitable, and PG&E has seen its revenues increase in recent years – the company’s 2023 $24.4 billion top line was up 12% from 2022.

The recent revenue gains are good news for PG&E, especially after the company’s difficulties arising from the fire seasons of 2018 and 2019. The company was investigated by Cal Fire after those fire seasons, and was found blameworthy for two of the large wildfires that made headlines in those years – the investigators found that PG&E power lines sparked the initial fires. In the wake of the liability findings, the company filed for Chapter 11 bankruptcy, and exited the legal proceedings in June of 2020.

On the business side, PG&E provides both natural gas and electric services across Northern and Central California. The company has a public commitment to providing sustainable power, and has its hands in both hydroelectric power generation and hydrogen as an alternative fuel.

In its last reported quarter, 2Q24, PG&E brought in $4.46 billion in revenue from electric services and $1.53 billion in natural gas revenues, for a total of $5.99 billion at the top line. That was up more than 13% year-over-year, and supported a non-GAAP EPS of 31 cents, up strongly from the 23-cent EPS recorded in 2Q23.

For Fowler, this electric company’s recent history of strong execution is the key point for investors, and he writes, “While the shares have lost steam relative to the group YTD in 2024, we think the relative pullback is reflective of a healthy investor rotation following nearly 100% relative outperformance off trough multiples set in late 2021. We view management as among the best in our coverage and they have cleaned up the story post emergence. Further, we think they have established an achievable, peer-leading path ahead as PCG starts to look more like a true regulated US utility.”

The analyst complements his stance with a Buy rating, and a price target of $24 that points toward an upside potential of nearly 21% on the one-year horizon. (To watch Fowler’s track record, click here)

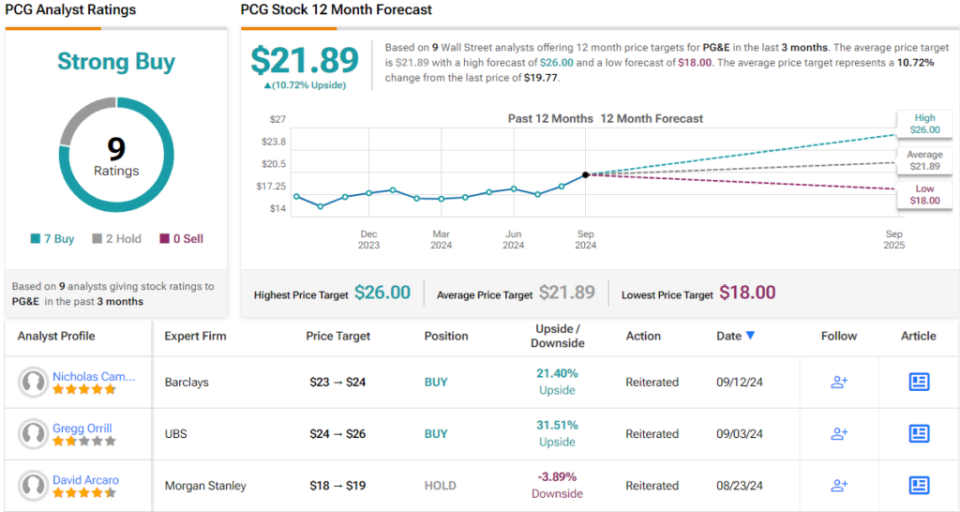

This utility stock has earned a Strong Buy consensus rating from the Street, based on 9 reviews that break down 7 to 2 in favor of Buy over Hold. The shares are trading for $19.77 and their $21.89 average target price implies a 12-month upside potential of ~11%. (See PCG stock forecast)

Sempra Energy (SRE)

Next up is Sempra Energy, another electric and natural gas company in the California market. This company, based in San Diego, serves more than 40 million customers, providing electricity in Southern California, in Texas, and in Mexico, and putting liquid natural gas (LNG) onto the export market.

The company’s California and Texas operations include providing electric power through modern networks with a focus on responsibility. In California, the company has this past July completed a new facility, a Wildfire and Climate Resilience Center, dedicated to improving and enhancing California’s ability to combat wildfires and the effects of climate change. In Texas, the company has expanded its power generation and high-voltage transmission lines.

Sempra operates through several subsidiaries, including the Southern California Gas Company, San Diego Gas & Electric, and, in Texas, Oncor Electric Delivery Company. The company’s LNG business is operated through Sempra Infrastructure, and includes facilities in Louisiana, Texas, and on the Pacific Coast of Mexico.

Looking at the financials, Sempra’s 2Q24 report showed a total of $3.01 billion in revenues, down almost 10% year-over-year, and earnings, by non-GAAP measures, of 89 cents per share based on total adjusted earnings of $567 million. We should note that these figures missed the forecasts, the revenues by $420 million and the EPS by 5 cents per share.

Despite the earnings misses, Fowler rates this stock highly, seeing it as a well-rounded energy firm. He notes that the LNG business gets the headlines – but adds that electricity delivery is Sempra’s core revenue driver.

“SRE share performance often gets caught up in headline noise related to LNG, despite the export business contributing >10% to our PO. We think value lies in the regulated utilities in California and Texas. Utility-heavy capital plans organically shift the earnings mix to regulated businesses. We think future LNG FIDs afford SRE opportunities to sell down equity in the infrastructure platform over time (beyond the 30% already sold). SRE’s pre-funded equity raise provides balance sheet flexibility for the first time in recent memory. We see a plentitude of incremental capex opportunities that could be added to the plan,” Fowler wrote.

These comments support Fowler’s Buy rating on SRE, while his price target, set at $94, suggests that the stock will gain more than 15% by this time next year.

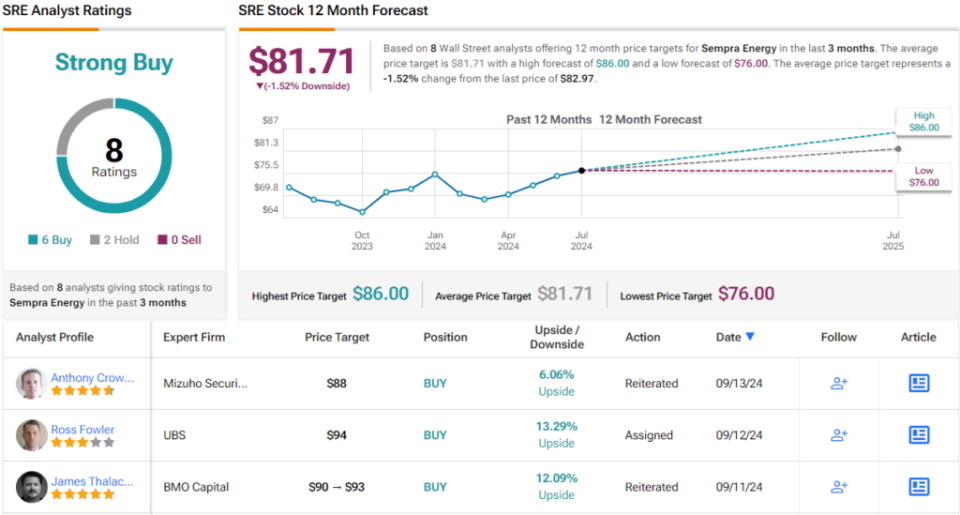

SRE has solid support amongst Fowler’s colleagues, but its current valuation presents a conundrum. SRE’s Strong Buy consensus rating is based on 6 Buys and 2 Holds. However, the $81.71 average price target suggests shares will stay rangebound for the time being. (See SRE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.