-

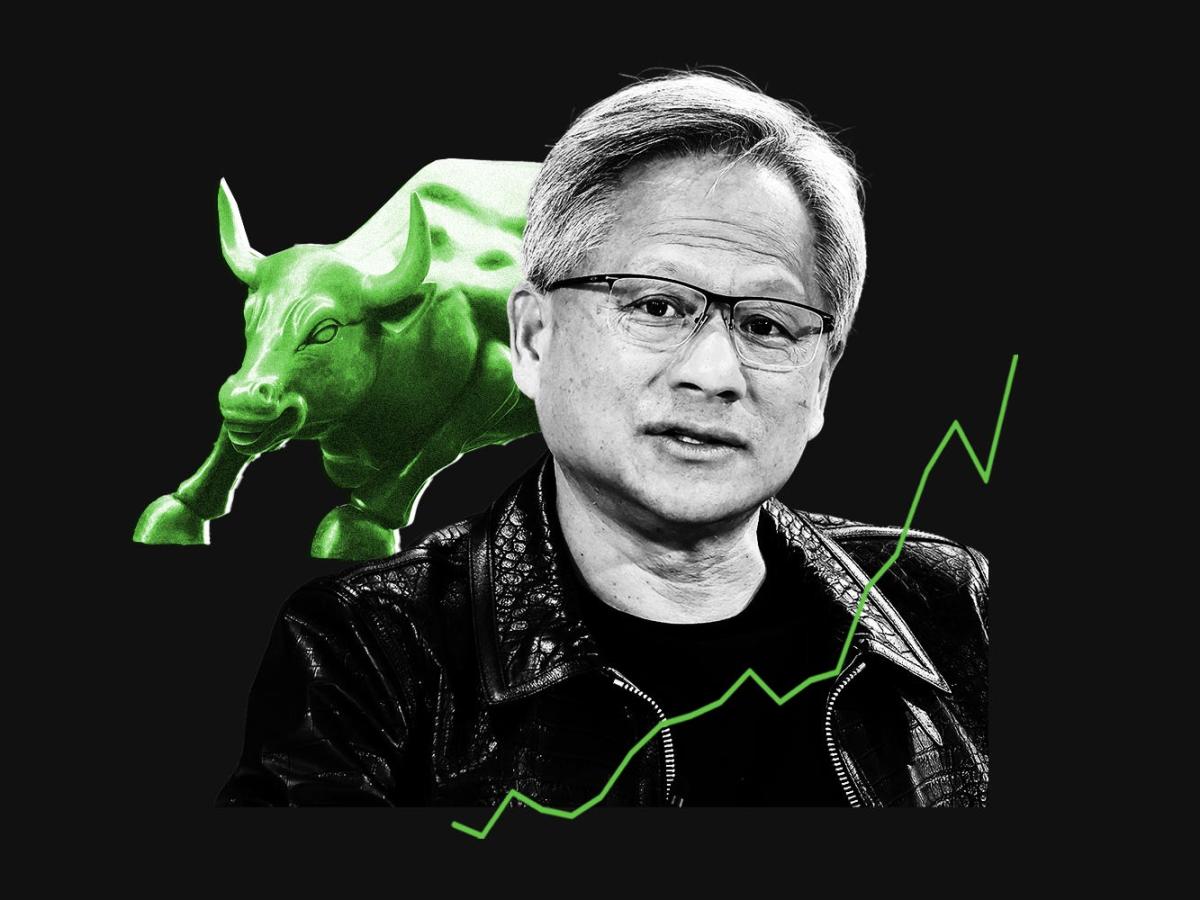

Nvidia stock has a lot more room to run, according to Dan Niles.

-

The Niles Investment founder compared Nvidia to Cisco prior to the peak of the dot-com bubble.

-

Nvidia shares could double in the next couple of years, he predicted.

Nvidia stock has slid since the company reported earnings last month, but its rally is nowhere close to over.

That’s according to Dan Niles, founder and portfolio manager of Niles Investment Management, who’s still bullish on the artificial intelligence titan for the foreseeable future.

That’s because firms are still willing to shell out on AI spending — and Nvidia looks like it’s following the same pattern as other firms that soared during past tech bubbles, he told CNBC in a recent interview.

“I still believe you have a lot of room for spend,” Niles said of AI. “What I’m saying is that in the short term, I think you’ve got a digestion phase that you just have to go through. I firmly believe that in the next several years, Nvidia’s revenues will again be able to double from current levels, and the stock will be able to double as well.”

Cisco, which dominated the internet bubble in the late nineties, saw its revenue peak at around 15 times what it posted in 1994, while its stock had soared nearly 4,000% from that year through 2000. It plunged during the dot-com crash, with shares plummeting around 85% peak-to-trough.

Nvidia shares, by comparison, have risen around 1,500% over the last six years. Niles suggested that this could mean the chipmaker has more upside ahead before a fallout.

“I’ve lived through ’01, ’02. These things can go on longer than you’ve ever imagined possible,” he added.

In the short term, Niles’ forecast is at the high end among analysts watching Nvidia. But most of Wall Street remains optimistic about the chipmaker in the quarters ahead, especially as the company looks poised to roll out its next-gen Blackwell AI chip.

Analysts have an average price target of $153.24 a share, according to Nasdaq data, implying another 44% upside from its current levels.

The chipmaker has hit a rough stretch in recent weeks, with shares dropping 27% from their peak earlier this summer.

Investors have been dismayed by the delay of the Blackwell chip, but more importantly, many are also questioning whether all of the billions of AI spending by Nvidia’s customers will end up generating a return anytime soon.

Read the original article on Business Insider