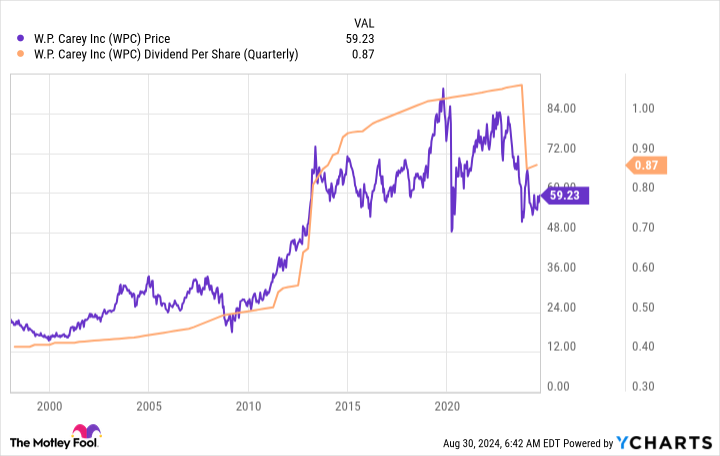

When you let someone down, you have to build back trust. That’s the position that W.P. Carey (NYSE: WPC) finds itself in today after announcing that it was cutting its dividend by roughly 20% at the end of 2023. A lot of investors simply won’t touch a dividend cutter, but it is worth giving this large net lease real estate investment trust (REIT) a second chance. Here’s why.

The cut that rocked W.P. Carey

W.P. Carey was on the cusp of achieving an important dividend milestone. Just a few months before it could claim a 25-year streak of annual dividend increases, the REIT, instead, chose to cut its dividend. For some, that move destroyed years of trust built up quarter by quarter, which is understandable.

However, the reason for the cut is important to understand. W.P. Carey looked at its portfolio and decided that it needed to get out of the office sector. That was something it had been doing gradually for years, but the upheaval in the office market following the coronavirus pandemic changed the math. Management felt ripping the bandage off would be better than having to materially write down the value of office assets for years into the future.

The company intended to spin off a large chunk of its office business and sell whatever it didn’t spin off. Prior to this new direction, office assets represented around 16% of the REIT’s rent roll. So the dividend cut basically represented the income lost and perhaps a little extra leeway to deal with the costs of the restructuring effort and general portfolio changes.

Just one quarter after the dividend cut, meanwhile, W.P. Carey got right back to increasing the dividend again. It has now increased the dividend for two quarters in a row, effectively getting back to the quarterly increase cadence that existed prior to the cut. The dividend increases were small, but that was the norm before the cut, too. The more important piece here is that the cut looks more like a reset than a change that was made from a position of weakness.

The portfolio remains strong at W.P. Carey

That was, actually, the whole point of the office spinoff. W.P. Carey had exposure to an asset class that was likely to face years of headwinds and it wanted to shift gears, which it believed would allow the positive attributes throughout the rest of the portfolio to shine. But what are those positives?

For starters, W.P. Carey is a net lease REIT. This means that it owns single-tenant properties for which the tenants are responsible for most property-level operating costs. Although any single property is high-risk, across a large portfolio this is a fairly low-risk business model. W.P. Carey owns nearly 1,300 properties, which is sizable. In fact, it is the second largest net lease REIT by market cap, after industry giant Realty Income (NYSE: O).

There are other similarities between these two REITs. For example, they both have operations in Europe, providing an additional lever for future growth. The net lease model is still fairly new in Europe, so this is a material avenue for long-term growth. Notably, W.P. Carey has more than two decades of experience in the European market and was there well ahead of Realty Income.

In addition, W.P. Carey and Realty Income both have diverse portfolios, but W.P. Carey’s portfolio is actually more diverse. Realty Income’s focus is on retail assets, which make up around 73% of rents. W.P. Carey’s portfolio breakdown is 35% industrial, 29% warehouse, and 21% retail, with the rest in a rather sizable “other” category. The industrial sector has been fairly attractive of late, with leases rolling over to much higher rates throughout the industry. As you might expect, W.P. Carey has had very strong lease renewal trends.

Meanwhile, W.P. Carey is sitting on a material amount of cash today. The exit from office real estate was a big piece of that, though there were some other recent asset sales that helped. But with a record level of liquidity, the REIT isn’t on the back foot. It is operating from a position of strength as it looks to regain investor trust. The healthy liquidity position suggests that it will, eventually, be able to get investors back on board with acquisition-driven growth.

The real reason to like W.P. Carey right now

So, despite making a major strategic change that necessitated a dividend cut, W.P. Carey remains a well-run and well-positioned REIT. It seems highly likely to, eventually, regain investor trust and might even be afforded a higher price tag once it does (now that office assets are no longer an overhang). W.P. Carey’s dividend yield is nearly 5.8% today, which is higher than that of Realty Income (5.1%) and the average REIT (3.9%). In other words, if you are a long-term dividend investor willing to take on an unloved stock that probably deserves more love than it gets, W.P. Carey looks like an attractive choice today.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $630,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 3, 2024

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.

What Does This High-Yield Stock Look Like After Its Dividend Cut? was originally published by The Motley Fool