From suspicious shilling to bad investments, several celebrities have ended up losing millions of dollars after attempting to dabble in digital assets.

Celebrities and cryptocurrencies are never a good mix.

Several A-listers have landed themselves in hot water after endorsing coins on social media, with some paying millions of dollars in fines and facing class action lawsuits.

Some have also had their fingers burned after buying pricey NFTs, only to see their value plummet substantially. Then again, these losses were probably a mere rounding error in their bulging bank accounts.

So without further ado, let’s take a look at five stars who might well wish they never jumped into crypto.

Tom Brady

The NFL legend was a vocal brand ambassador for FTX — appearing in multiple adverts to claim that it was a fast, easy and safe way of investing in crypto.

Unfortunately for the doomed exchange’s customers though, it proved to be anything but, and they ended up frozen out of their savings.

Brady also ended up nursing a substantial loss after Sam Bankman-Fried’s firm went bust, not least because his 1.1 million common shares in the company were rendered worthless.

If that wasn’t enough, he and several others are being sued by aggrieved FTX users, who allege their endorsements were “responsible for the many billions of dollars in damages caused.”

That case continues to wind its way through the courts — and to add further salt to the wound, Sam Bankman-Fried is helping the plaintiffs. Ouch.

Logan Paul

YouTubers have also found themselves in a spot of bother after attempting to launch crypto projects.

One of them was Logan Paul, who was the mastermind behind CryptoZoo — “a really fun game that makes you money.”

There was just one problem: the game has never launched, despite fans spending millions of dollars on non-fungible tokens.

CryptoZoo also faced a number of brutal in-depth investigations from a rival YouTuber called Coffeezilla.

Paul ended up apologizing — and a year later, he started to buy back NFTs from fans on the condition that they won’t sue him.

Lindsay Lohan

In a marked departure from her previous career as a child film star, Lindsay Lohan became an aggressive promoter of crypto projects and NFT collections on social media.

There was just one problem: a lot of the time, she didn’t disclose to her followers that she was being paid to do so.

That led to some unwelcome attention from the Securities and Exchange Commission, which accused her of boosting Justin Sun’s Tron and BitTorrent tokens.

She ultimately settled the SEC charges, and joined the likes of Ne-Yo and Akon in paying a combined $400,000.

Rather embarrassingly, a spreadsheet leaked by @zachXBT on X suggested that Lohan regularly charged $25,000 to shill projects — or $20,000 for a retweet.

Another painful reminder not to believe everything you see on social media.

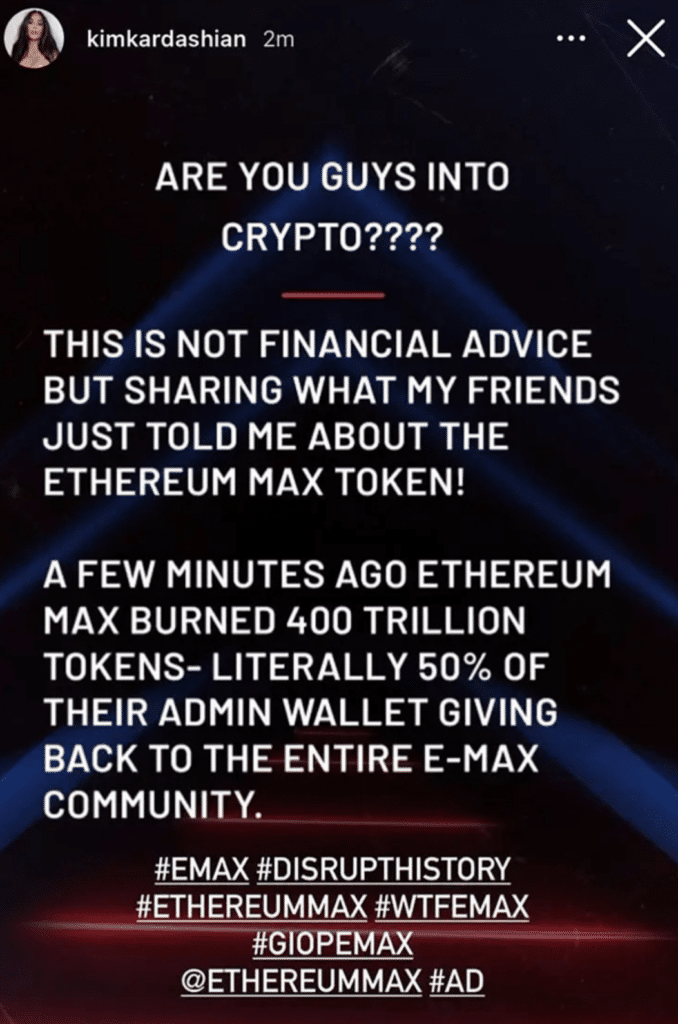

Kim Kardashian

Kim K has a huge following on Instagram, and, like Lohan, used her immense public profile to endorse a little-known altcoin called Ethereum Max.

British officials claimed the post “might have been the financial promotion with the single-biggest audience reach in history.”

The SEC managed to get her to pay a $1.26 million penalty, and agree not to endorse cryptocurrencies on social media for three years.

In that case, she was paid a jaw-dropping $250,000 to plug EMAX.

The altcoin ended up rapidly losing 98% of its value after her post, leading to allegations it was nothing more than a pump-and-dump scheme.

Justin Bieber

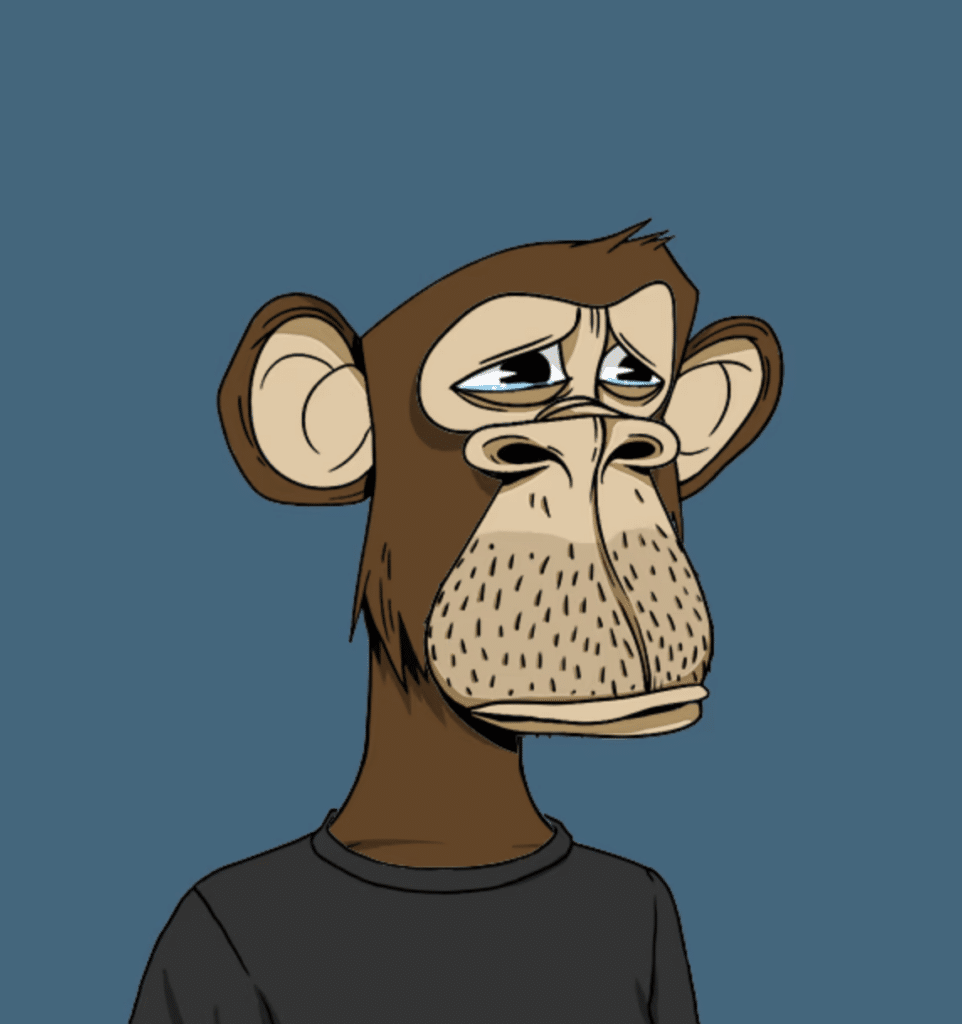

Last but by no means least, let’s spare a thought for the baby-faced crooner Justin Bieber.

He shelled out a staggering $1.3 million for a Bored Ape during the height of NFT mania, but the floor price of this collection has since plummeted in value.

It’s difficult to deduce the exact value of his collectible at the moment, especially considering it has a number of rare attributes, but the best offer currently listed on OpenSea stands at just 8.488 WETH. That’s just $28,500 at current market rates.

If he was crazy enough to accept such a bid, he would end up crystallizing a loss of 97.8%.