If you’re holding shares of Walgreens Boots Alliance (NASDAQ: WBA) in hopes of it turning around promptly, I think that now is the time to cut your losses on the struggling pharmacy chain and allocate your capital elsewhere. Here’s why.

A common investing thesis for this stock is now dead

One of the criteria that can help an investor decide when to sell a stock is whether the investing thesis they formed as a rationale for buying the stock is still valid.

Let’s assume you bought Walgreens stock 10 years ago, expecting it to be a safe stock that generates steady and growing dividend income, and modest share-price appreciation. You may have also anticipated that its line of business, providing retail pharmacy services, would hold up relatively well over time even if the world changed a lot.

But that thesis hasn’t played out as planned.

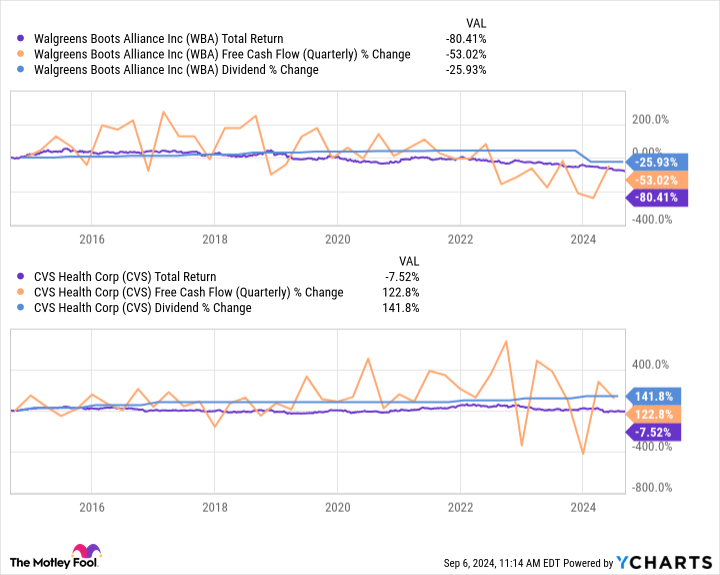

In the past 10 years, the total return of the stock has declined by just over 80%. In the same period, quarterly free cash flow (FCF) has dwindled by 53% to just $327 million. In early January of this year, Walgreens slashed its quarterly dividend by 48% compared to the prior quarter, to $0.25 per share.

And in the trailing-12-month period alone, the company spent nearly $27 billion on debt repayment, denying the use of that capital for growth initiatives or for returning it to shareholders.

So, to recap: It wasn’t a safe investment, it didn’t offer consistent dividend income, and even though people still need to go to a pharmacy to get their prescriptions, that factor apparently hasn’t been relevant to preserving the stock’s price.

Furthermore, it is not the case that the pharmacy industry as a whole has struggled, which would at least be a consolation for the stock’s underperformance. Walgreens’ biggest competitor, CVS Health, saw the total return of its shares decline by around 4% in the last 10 years while its quarterly FCF and dividend soared. Take a look at this chart:

So what’s sinking Walgreens? Its core prescription-filling segment continues to hold up relatively well, expanding the number of prescriptions (excluding immunizations) filled by 1.7% year over year as of its fiscal third quarter (which ended May 31).

But sales of nonprescription healthcare goods are softening, as are prescription reimbursements from insurers. The boost the company got as the economy reopened in 2021 is now long past. More importantly, its bid to diversify into providing primary care is costly and although not a money-burner any more, is still nowhere close to contributing enough to prop up the top or bottom line.

There’s no concrete hope for salvation on the horizon. The only path forward in the near term will be for Walgreens to continue selling off its investments and other assets to service its debt, while trimming operating costs and pushing its most profitable segments forward. Such moves could cause it to leave some revenue on the table. And its total assets will likely continue to shrink, which will drag the share price down more.

Even if you’re patient, it’s time to sell

It’s true that Walgreens could salvage itself over the next decade or more. Eventually its primary care segment could be a formidable profit center. And its retail pharmacy segment could become efficient again, with enough time.

But there isn’t much evidence of those processes getting very far beyond the starting line yet. Nor are shareholders obligated to hang around after their investing thesis is invalidated, regardless of the precise reasons.

Therefore, I think the best move is to sell the stock now. Even if you’re optimistic about a recovery — and it’s hard to see why at the moment — more downward movement of the stock could be looming. It’s safer to back out now, and then return later if you detect the seedlings of a restoration.

Should you invest $1,000 in Walgreens Boots Alliance right now?

Before you buy stock in Walgreens Boots Alliance, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walgreens Boots Alliance wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $652,404!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool recommends CVS Health. The Motley Fool has a disclosure policy.

1 Healthcare Stock to Sell Now and Never Look Back was originally published by The Motley Fool